Alessandro Martinello

I am currently Head of Data and Analytics at Realkredit Danmark. I have been in both academia and policy after obtaining my PhD, and in this website you can also find some of the papers I have worked on. While time is limited today for side projects, every once in a while I manage to create something useful enough to share via GitHub.

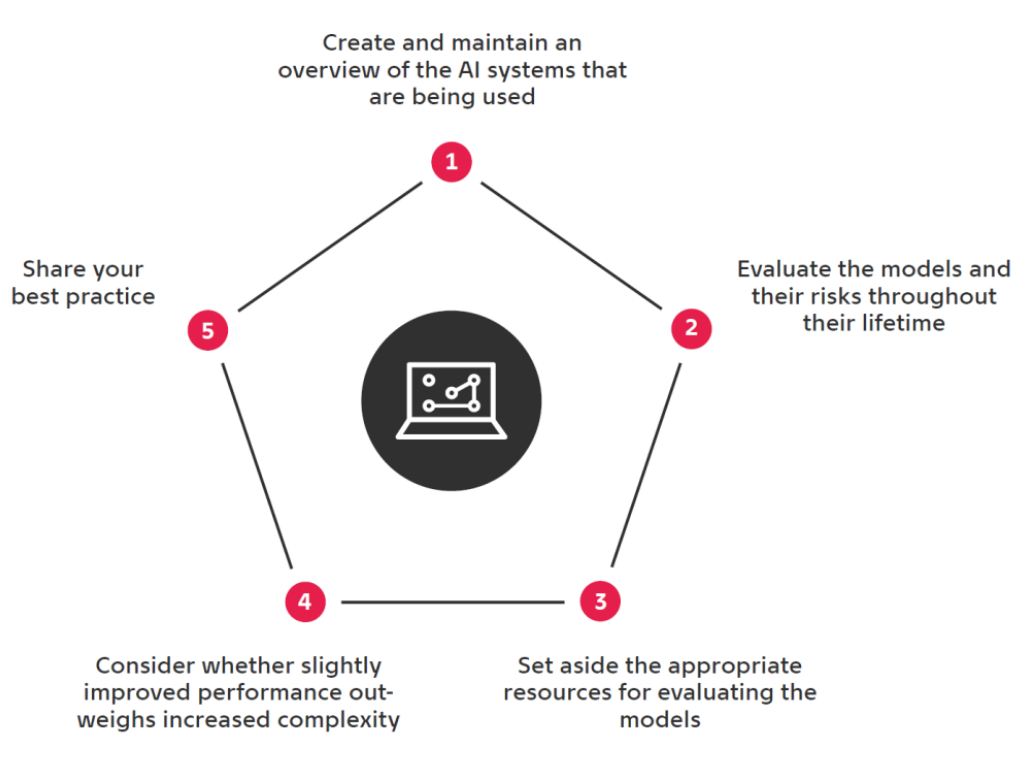

AI and machine learning in the financial sector: Five focus points

Published Apr 25, 2022

You might know that the #europeancommission has submitted a proposal for an AI act.

The proposal defines high-risk AI systems, requires minimum governance structures for such systems, and imposes large fines for lack of compliance, up to 6% of a firm’s global turnover.

The proposal as it stands will have consequences for the financial sector. Among high-risk systems, the act specifically includes systems for credit risk scores applied to natural persons - not only those using machine learning, but also those using standard statistical tools (logit, OLS, whatnot).

At Danmarks Nationalbank we have studied both the academic and non-academic literature, and consulted with national and international experts to understand the challenges and best practices in using AI in the financial sector. While machine learning is not a new paradigm for banks and financial institutions, who are used to exploit microdata and models to inform their business, it can amplify existing risks.

In this memo we summarize our findings, and suggest five focus points for financial institution to consider when moving from static statistical models to self-learning, dynamic AI systems.

Have a read, and if you have any input, let us know!